Smartphones and tablets powered by Google’s Android software are devouring the mobile gadget market, eating into Apple’s turf by feeding appetites for innovation and low prices, analysts say.

The Android operating system powered nearly three out of four smartphones shipped worldwide in the recently ended quarter as the mobile platform dominated the market, according to industry trackers at IDC.

Samsung’s Galaxy S3 smartphone is powered by Android.

“Android has been one of the primary growth engines of the smartphone market since it was launched in 2008,” said IDC’s mobile phones research manager Ramon Llamas.

“In every year since then, Android has effectively outpaced the market and taken market share from the competition.”

In tablets, Apple’s market share has fallen to just over 50 per cent from 65 per cent in the second quarter as Android devices gain ground, according to IDC figures.

“Having a lot of people building a lot of things covering a lot of price points with multiple brands in multiple places makes a big difference,” said NPD Group analyst Stephen Baker.

“Variety is strength when it comes to moving units.”

Android smartphones shipments surged to 136 million, topping those in the same three-month period last year by slightly more than 90 per cent, IDC reported.

Samsung’s Galaxy S3 overtook Apple’s iPhone 4S in the third quarter to give the South Korean firm the world’s best-selling smartphone model for the first time ever, according to research firm Strategy Analytics.

“The pace of innovation in Android is faster than Apple,” said Gartner vice-president of mobile computing Ken Dulaney. “They are just trying harder; Apple is way behind in that area.”

Android is benefiting from being an “open-source” platform that gadget makers use free of charge and improve as they deem fit, providing Google with insights along the way.

Apple tightly controls its products from the software to the hardware and even the online shop for music, books, games or other content.

“What you get with Android is this incredible feedback loop with developers, equipment makers, customers, and designers,” Dulaney said.

“At Apple, as long as they have a great vision internally it is fine but they don’t have the feedback Android does.”

Having thousands of different Android devices vying for consumers’ cash is a strength when it comes to market share but puts hardware makers into a fiercely competitive arena, Baker noted.

“Other than Samsung, I don’t know if other Android guys are making money,” the analyst said.

Google gives Android away free, but the platform is crafted to make it easy for people to use the California Internet titan’s money-making services such as search and maps, and get content at its online Google Play shop.

Forrester analyst Charles Golvin said that forces powering Android momentum include changing demographics of smartphone buyers.

Early adopters of smartphones focused more on new technology than on price, but the devices have gone mainstream with cost increasingly important to shoppers, according to Golvin.

“People are more inclined towards the Android platform because there is more choice and most of that choice is low price,” Golvin said.

The open nature of Android and the myriad models offered by gadget makers serve as a “double-edged sword,” warned the analyst.

Apple pushes annual updates of iOS mobile operating system out to its devices, while new versions of Android hit more often but must get through hardware makers and telecom services to get onto people’s handsets.

“You have this lengthy chain of intermediaries who are delaying the delivery of that new software and its innovations to existing devices in the market,” Golvin said.

He backed his point by noting that many Android devices in use still run on generations-old versions of the operating system.

Android gadget variety can also make it tough to design accessories or even “apps” that can be used across the array of devices.

For its part, Google has done an excellent job of improving the “ecosystem” of music, films, apps, books and more available for Android-powered devices, according to analysts.

In the red-hot tablet market effectively created by the iPad, strong growth is being seen by Android rivals including Amazon’s popular Kindle Fire and Nook devices from Barnes & Noble, which run custom versions of the software.

Analysts believe that the Google-backed operating system is likely to spread to typically “dumb” gizmos like appliances.

“These platforms are becoming the molecule elements for building all kinds of hybrid devices,” Dulaney said. — AFP-Relaxnews

Google release the latest system, android 4.2. Do you think it's a good news for many android users? In fact, to get android 4.2 on your android phone, lots of samsung galaxy s3 user are looking for the way to update galaxy s3 to android 4.2, if you're using galaxy s3, do you know how to upgrade galaxy s3 to jelly bean 4.2? Don't worry at all, here is provide you an instruction to the quick way to update galaxy s3 with android 4.2 just using Thunderbolt Custom ROM Firmware. Keeping reading this guide, you'll learn more from here.

Google release the latest system, android 4.2. Do you think it's a good news for many android users? In fact, to get android 4.2 on your android phone, lots of samsung galaxy s3 user are looking for the way to update galaxy s3 to android 4.2, if you're using galaxy s3, do you know how to upgrade galaxy s3 to jelly bean 4.2? Don't worry at all, here is provide you an instruction to the quick way to update galaxy s3 with android 4.2 just using Thunderbolt Custom ROM Firmware. Keeping reading this guide, you'll learn more from here. Google release the latest system, android 4.2. Do you think it's a good news for many android users? In fact, to get android 4.2 on your android phone, lots of samsung galaxy s3 user are looking for the way to update galaxy s3 to android 4.2, if you're using galaxy s3, do you know how to upgrade galaxy s3 to jelly bean 4.2? Don't worry at all, here is provide you an instruction to the quick way to update galaxy s3 with android 4.2 just using Thunderbolt Custom ROM Firmware. Keeping reading this guide, you'll learn more from here.

Google release the latest system, android 4.2. Do you think it's a good news for many android users? In fact, to get android 4.2 on your android phone, lots of samsung galaxy s3 user are looking for the way to update galaxy s3 to android 4.2, if you're using galaxy s3, do you know how to upgrade galaxy s3 to jelly bean 4.2? Don't worry at all, here is provide you an instruction to the quick way to update galaxy s3 with android 4.2 just using Thunderbolt Custom ROM Firmware. Keeping reading this guide, you'll learn more from here. Microsoft has released the Windows 8 Pro recently. Moreover, Windows 8 Consumer Preview is available for free download. The new features of Windows 8 are available here:

Microsoft has released the Windows 8 Pro recently. Moreover, Windows 8 Consumer Preview is available for free download. The new features of Windows 8 are available here: The best way to gain and preserve a positive Internet reputation is to offer exceptional product and service. However, this still is not enough to protect your business from false accusations or angry complaints online. You need to know what is being said about your company name, work on damage control and fight negative views with positive content.

The best way to gain and preserve a positive Internet reputation is to offer exceptional product and service. However, this still is not enough to protect your business from false accusations or angry complaints online. You need to know what is being said about your company name, work on damage control and fight negative views with positive content. Google is working on an open alternative to Apple's AirPlay wireless streaming technology, which the company wants to use to link Android devices to Google TV devices.

Google is working on an open alternative to Apple's AirPlay wireless streaming technology, which the company wants to use to link Android devices to Google TV devices. If you're a Facebook addict with a Firefox craving, or the other way around, a new feature in Firefox will have you salivating. We show you how to use the new Facebook Messenger integration in Firefox.

If you're a Facebook addict with a Firefox craving, or the other way around, a new feature in Firefox will have you salivating. We show you how to use the new Facebook Messenger integration in Firefox. Windows lets you customize its look in lots of ways, and one of the coolest is the ability to change almost any icon to suit your style or to create themes. While there's no shortage of icons available online, why not make your own? It's much easier than you might think, especially with the help of Axialis IconWorkshop. True to its name, it handles just about every aspect of the job, from creating, extracting, and converting icons to managing whole libraries of them.

Windows lets you customize its look in lots of ways, and one of the coolest is the ability to change almost any icon to suit your style or to create themes. While there's no shortage of icons available online, why not make your own? It's much easier than you might think, especially with the help of Axialis IconWorkshop. True to its name, it handles just about every aspect of the job, from creating, extracting, and converting icons to managing whole libraries of them. Smartphones and tablets powered by Google’s Android software are devouring the mobile gadget market, eating into Apple’s turf by feeding appetites for innovation and low prices, analysts say.

Smartphones and tablets powered by Google’s Android software are devouring the mobile gadget market, eating into Apple’s turf by feeding appetites for innovation and low prices, analysts say. The Galaxy S Mini didn’t make a splash hitting U.S. shelves, but the teacup version of Samsung’s flagship Galaxy S III has in fact arrived stateside.

The Galaxy S Mini didn’t make a splash hitting U.S. shelves, but the teacup version of Samsung’s flagship Galaxy S III has in fact arrived stateside. This simple app shows you the latest deals from major stores so you can map out your shopping attack plan. Rather than flipping through circulars, this app has all the deals listed out for you, and you can save the best deals to a favorites list so you can refer back to it when you're out in the trenches on Black Friday.

This simple app shows you the latest deals from major stores so you can map out your shopping attack plan. Rather than flipping through circulars, this app has all the deals listed out for you, and you can save the best deals to a favorites list so you can refer back to it when you're out in the trenches on Black Friday. The online store that got famous for shoes (and fantastic service) is not just for shoes anymore. So if you want to avoid the crowds and inevitable traffic, Zappos has one of the most intuitive shopping apps available.

The online store that got famous for shoes (and fantastic service) is not just for shoes anymore. So if you want to avoid the crowds and inevitable traffic, Zappos has one of the most intuitive shopping apps available. People who want to take Office 2013 for a spin can download a 60-day evaluation edition.

People who want to take Office 2013 for a spin can download a 60-day evaluation edition. Google has launched updated versions of its Blogger mobile apps for Android and iOS, bringing the version number on both platforms to 2.0.

Google has launched updated versions of its Blogger mobile apps for Android and iOS, bringing the version number on both platforms to 2.0. The 2013 updates to the Kaspersky protection suites bring to consumers some of the most advanced security technology currently available. It involves introducing an exploit prevention engine as part of the security suite, but also a Safe Money banking protection tool that you can interact directly with. The suite's scans aren't the fastest, but it definitely will protect you.

The 2013 updates to the Kaspersky protection suites bring to consumers some of the most advanced security technology currently available. It involves introducing an exploit prevention engine as part of the security suite, but also a Safe Money banking protection tool that you can interact directly with. The suite's scans aren't the fastest, but it definitely will protect you. You can now get a taste of Firefox OS straight from your desktop browser, thanks to a new Firefox add-on called r2d2b2g that bakes a Firefox OS simulator right into your desktop browser.

You can now get a taste of Firefox OS straight from your desktop browser, thanks to a new Firefox add-on called r2d2b2g that bakes a Firefox OS simulator right into your desktop browser. Google is prepping Google Maps for the iPhone, offering a fix for customers dissatisfied with Apple’s poorly received Maps app, according to a report.

Google is prepping Google Maps for the iPhone, offering a fix for customers dissatisfied with Apple’s poorly received Maps app, according to a report. Finland's biggest game studio is heading back into the coop, pulling out its Angry Birds franchise for yet another go on a whole mess of platforms -- this time, even Windows 8 and its mobile counterpart get some attention. Moreover, Rovio's teamed with the folks at LucasArts (now part of the Disney family) to craft an entirely thematic experience: enter Angry Birds Star Wars. But fret not -- just because Angry Birds Star Wars seems like a shameless tie-in doesn't mean it's a bad game (it is, however, a shameless tie-in, no matter which way you cut it).

Finland's biggest game studio is heading back into the coop, pulling out its Angry Birds franchise for yet another go on a whole mess of platforms -- this time, even Windows 8 and its mobile counterpart get some attention. Moreover, Rovio's teamed with the folks at LucasArts (now part of the Disney family) to craft an entirely thematic experience: enter Angry Birds Star Wars. But fret not -- just because Angry Birds Star Wars seems like a shameless tie-in doesn't mean it's a bad game (it is, however, a shameless tie-in, no matter which way you cut it). Often when an employee departs, they take important Excel passwords with them. This guide outlines how to use a simple Excel password recovery application to crack lost or forgotten passwords, allowing you to unlock password-encrypted Microsoft Excel documents quickly as possible.

Often when an employee departs, they take important Excel passwords with them. This guide outlines how to use a simple Excel password recovery application to crack lost or forgotten passwords, allowing you to unlock password-encrypted Microsoft Excel documents quickly as possible. Samsung's Chromebooks have been priced in the $500 range with a build quality a step above what most netbooks have to offer. As you might expect, now that the price has been slashed to $249, it feels slightly cheaper than the last-generation Series 5 550 -- but only slightly. With the exception of the palm rest, which used to be made of inlaid metal, this has the same look and feel as the Chromebook we reviewed earlier this year.

Samsung's Chromebooks have been priced in the $500 range with a build quality a step above what most netbooks have to offer. As you might expect, now that the price has been slashed to $249, it feels slightly cheaper than the last-generation Series 5 550 -- but only slightly. With the exception of the palm rest, which used to be made of inlaid metal, this has the same look and feel as the Chromebook we reviewed earlier this year. When you connect to the Internet at home, you’re almost certainly using a form of broadband. Broadband is defined by various standards as being capable of transmitting data at 1.5 or 2 Megabits (Mbits) per second. This type of speed is necessary for streaming high definition video, playing online games and sending and receiving large amounts of data.

When you connect to the Internet at home, you’re almost certainly using a form of broadband. Broadband is defined by various standards as being capable of transmitting data at 1.5 or 2 Megabits (Mbits) per second. This type of speed is necessary for streaming high definition video, playing online games and sending and receiving large amounts of data. Imagine an alternate universe where it’s the summer of 2011 and Apple has introduced a $199 iPad mini. Apple Fan boys explode. Non Apple-fans start lining up to get their hands on the first truly affordable and obviously awesome tablet. And it’s game-over for the 7-inch Android tablet competition.

Imagine an alternate universe where it’s the summer of 2011 and Apple has introduced a $199 iPad mini. Apple Fan boys explode. Non Apple-fans start lining up to get their hands on the first truly affordable and obviously awesome tablet. And it’s game-over for the 7-inch Android tablet competition. Some of the Android 4.2 upgrades are minor. Sure, it might be nice to use the Photo Sphere feature to stitch together photos to from Google Street View style panoramic images, but you're not going to do that more than once every blue moon. It's also nice that the 4.2 Play Store app includes a personalized music-shopping function, Music Explorer. Thanks to personalized music services such as Pandora, I really don't need more help in finding new music.

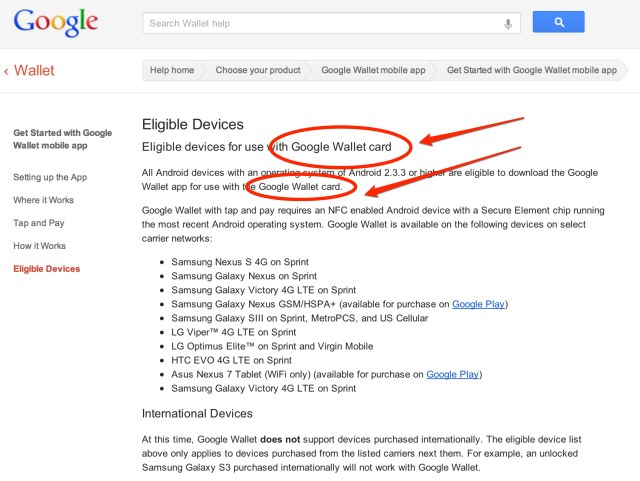

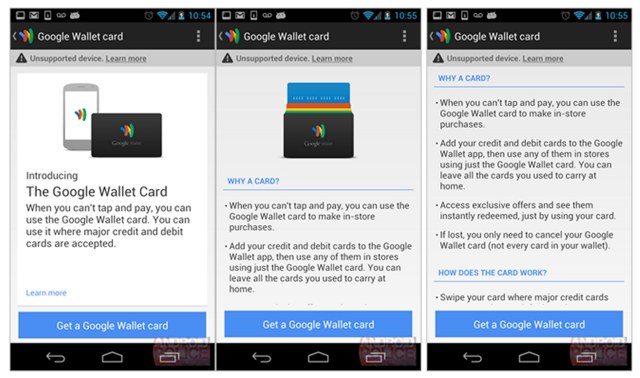

Some of the Android 4.2 upgrades are minor. Sure, it might be nice to use the Photo Sphere feature to stitch together photos to from Google Street View style panoramic images, but you're not going to do that more than once every blue moon. It's also nice that the 4.2 Play Store app includes a personalized music-shopping function, Music Explorer. Thanks to personalized music services such as Pandora, I really don't need more help in finding new music. Just in case you needed more proof that the leaked news revealing a forthcoming physical Google Wallet Card is indeed legit, you can just visit Google’s own Help section on its Google Wallet website to catch a reference to the yet-to-be announced addition. On the page entitled “

Just in case you needed more proof that the leaked news revealing a forthcoming physical Google Wallet Card is indeed legit, you can just visit Google’s own Help section on its Google Wallet website to catch a reference to the yet-to-be announced addition. On the page entitled “

If there is one altar at which Silicon Valley worships, it is the shrine of the holy network effect. Its mystical powers pluck lone startups from obscurity and elevate them to fame and fortune. The list of anointed ones includes nearly every technology success story of the past 15 years. Apple, Facebook, Microsoft, eBay, and PayPal, have each soared to multi-billion-dollar valuations on the supreme power of the network effect.

If there is one altar at which Silicon Valley worships, it is the shrine of the holy network effect. Its mystical powers pluck lone startups from obscurity and elevate them to fame and fortune. The list of anointed ones includes nearly every technology success story of the past 15 years. Apple, Facebook, Microsoft, eBay, and PayPal, have each soared to multi-billion-dollar valuations on the supreme power of the network effect.

I have been on the Verizon Share Everything plan since it first became available. The ability to share a big bucket of data accessible by multiple devices fits my gadget-flush lifestyle. I currently have a mobile hotspot, iPhone 4S, and an iPad 3 on the plan.

I have been on the Verizon Share Everything plan since it first became available. The ability to share a big bucket of data accessible by multiple devices fits my gadget-flush lifestyle. I currently have a mobile hotspot, iPhone 4S, and an iPad 3 on the plan.

WeChat Messenger is a top mobile voice and text chat application with friend-discovery social features and shared streaming photo feeds from friends’ personal photo albums!

WeChat Messenger is a top mobile voice and text chat application with friend-discovery social features and shared streaming photo feeds from friends’ personal photo albums! You may want Apple’s new 7-inch iPad mini tablet, but don’t click on that offer for a free one making the rounds on Facebook.

You may want Apple’s new 7-inch iPad mini tablet, but don’t click on that offer for a free one making the rounds on Facebook. The PayPal API lets developers tie in-app purchases to PayPal, which claims more than 100 million active accounts. Microsoft pointed to the free Crowdstar game Fish With Attitude as an example of a Windows Store app that uses PayPal for in-app purchases of game characters.

The PayPal API lets developers tie in-app purchases to PayPal, which claims more than 100 million active accounts. Microsoft pointed to the free Crowdstar game Fish With Attitude as an example of a Windows Store app that uses PayPal for in-app purchases of game characters. Microsoft’s new Surface tablet. The apps are now coming. — AFP pic

Microsoft’s new Surface tablet. The apps are now coming. — AFP pic